INTRODUCTION

The climate crisis is intensifying and affecting people around the world; a recent study by the journal Nature found that 85% of the global population has experienced weather events linked to global warming. From fires to floods, heatwaves to “bomb cyclones”, many of us are experiencing the effects of global warming not in some distant future but today.

Today’s crisis is forcing people to invest more in climate change, and they are finding new ways to do so. It does not depend on how much is found but rather contributes to the climate crisis. Investing in and moving the retirement fund to address the climate crisis is a way to solve it. (Arthur Rempel, Joyeeta Gupta, Energy Research & Social Science, 2020).

Recent studies show that many people are unhappy or find it inappropriate to invest their money in companies that are causing climate destruction, such as oil and gas companies.

The largest asset managers are collectively holding about trillions of dollars, which are invested in companies that are contributing to climate destruction and climate crises. Deforestation, fossil fuel extraction, and other expansions are not only causing climate destruction but also, it is affecting human rights, including black and other communities.

What are the causes, and how are they harming?

For a long time, retirement investments and savings have been a major pillar of financial security. Millions of people and workers invest blindly in these types of companies because they feel secure about their future and believe their money will be saved for future purposes. But if it is not helping but destroying it? As the climate crisis escalates, growing scrutiny is being placed on the role retirement investments play in funding companies that accelerate environmental degradation.

Most of the retirement investments are structured in a way that they are a mixture of stocks, gold, bonds, and property. These investments are major contributors to companies, which are primarily oil and fossil companies that are significant participants in climate destruction. Some banks are also contributors to environmental destruction projects.

Major oil and gas companies, such as ExxonMobil, Chevron, and Shell, are frequently among the top holdings in large mutual funds and exchange-traded funds (ETFs). They are emitting a huge amount of greenhouse gases, so if you are investing in these types of companies, you are supporting the projects that are causing the climate crisis by using continuous extraction and burning of fossil fuels.

The lack of education and awareness among investors is a major cause of climate damage, which leads them to act blindly. Some people are not actually aware of the type of assets they have or are investing in. The names of companies can distract and mislead them, such as ‘growing funds’, which reveals the true nature of the companies.

READ MORE: The Role of Global Climate Agreements: Are They Doing Enough?

Furthermore, the plans are not often broken down in detail by administrators and advisors unless they are asked clearly. In the absence of lucidity, the foundation of trust erodes, resulting in an environment fraught with uncertainty.

People with uncertainty and distrust. They are unaware that their money is contributing to environmental sustainability or addressing climate crises. For example, BlackRock defined its intention to make climate crises a ‘defining factor’ in investment decisions. To date, the company has maintained significant stakes in coal, oil, and gas companies. This difference between public pronouncements and actual investment practices has created criticism and allegations of greenwashing.

How will it affect you?

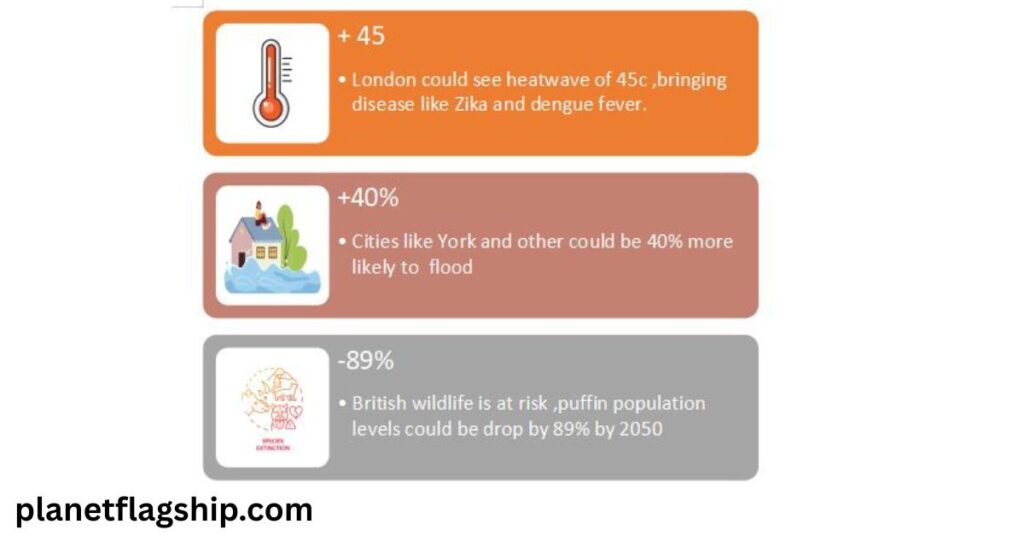

The economy and the environment are so closely linked that if we don’t act, the UK could see huge changes by the end of the century:

World climate indicators are warning that the temperature will increase above 4 °C by the end of this century because people’s behavior is not changing. This poses a significant threat to our lives and the lives of our loved ones. Scientists and environmentalists believe that if we want to surplus this risk and save our world, our first aim is to reduce emissions as much as we can because the temperature is already rising to 1.5c by industries, which is causing higher risk, and we must stop it to 1.5c by now according to Paris agreement.

As could the rest of the world

All this could significantly impact whether companies can make profits in the future, shrinking your pension pot while raising your costs of living.

Climate change won’t just affect your financial health either. Pollutants linked to climate change are known to cause cancer, asthma, strokes, and heart disease, and air pollution alone causes 43,000 premature deaths in the UK every year.

Role Of ESG In Retirement Funding and Climate Destruction

In recent times, many companies have referred to the ESG” Environmental Social Governance Fund“. These types of funds are specially categorized as eco-friendly, focusing not only on financial benefits but also on environmental impact. Aside from that, there are still many ESG funds that invest in fossil fuel companies and others that negatively impact the environment.

The major concern is the lack of uniform standards that can define ‘sustainable’ or ‘responsible’ investment. Some ESG frameworks omit all harmful companies, including those in the oil industry, which is more aligned with sustainability, while others only remove coal industries.

Personal Initiatives to Diminish the Climate Crises

Research by Carbon Tracker and As You Sow reveals that trillions of dollars in retirement savings are invested in fossil fuels. In the U.S., public pension funds hold over $3 trillion in assets, much of which is invested in industries that contribute to climate change. This implies that, as individuals, it’s our responsibility and personal initiative to reduce our carbon footprints by using or reducing vehicular travel, adopting a plant-based diet such as a soya bean-based protein, or installing solar energy systems individually on our houses. Their retirement investments may inadvertently fund these endeavors, contributing to ecological devastation.

Climate change and its crises are already having very harmful effects, as we are seeing, with disasters disturbing communities and destroying ecosystems. Retirement savings are crucial for our secure future, as they will cover our future expenses. The large number of sectors contributing to these industries is a case of very harmful effects on the earth.

Most people abandoned their assets as if they were transitioning to a low-carbon economy. Other than that, from a financial point of view, investments in fossil fuels are extremely risky. If the government implements strict policies on clean climate and energy resources that become more competitive, the long-term profits of fossil fuel companies are in doubt.

This does not mean that you are unable to make retirement investments. With a bit of research and action, you can align your retirement savings with a proper planning and Eco-friendly way.

1. Check Your Investments

Start by finding out exactly where your money is going. Use tools like Fossil Free Funds (https://fossilfreefunds.org/) by As You Sow to check your retirement fund’s exposure to fossil fuels and other harmful industries.

2. Search for right options

Talk to your employer, plan administrator, or financial advisor about offering fossil-free or ESG options that are truly aligned with sustainable goals. Many plans already have these alternatives, but they’re not always advertised or made the default.

3. Deliberate on a Rollover

If your employer-sponsored plan is limited, you can roll over part or all your savings into a self-directed IRA that allows you to choose fossil-free or socially responsible funds.

4. Support environment friendly

Join campaigns or advocate for legislation that pushes for more transparency and

divestment from fossil fuels at the institutional level. Some cities and states are already moving public pensions toward climate-friendly investments.

- Awareness among people

Educate others about the issue. Retirement investing is often viewed as a dry financial topic, but it has significant climate implications that warrant public attention. Retirement funds represent a powerful lever for change.

With trillions of dollars under management, even modest shifts in how that money is invested could have profound impacts on the global economy and the planet. Redirecting capital away from industries that harm the climate and toward solutions that support sustainability is not only good for the earth but also the economy. It’s becoming an increasingly smart financial move.

6. Renewable energy resources

People should be aware of renewable energy resources and explore different renewable energy investments, such as wind energy, solar panels, and hydropower plants. Investing in these types of projects can provide attractive returns while supporting the transition to a sustainable economy. Solar, wind, and other alternative energy sources offer significant growth potential and can significantly reduce an investor’s carbon footprint, contributing to a sustainable future.

Frequently Asked Questions

How can my retirement fund harm the environment?

Many retirement funds invest in fossil fuel companies that fund oil drilling, pipelines, and other carbon-heavy projects directly contributing to climate change.

Why are pension funds still investing in fossil fuels?

Because fossil fuels have historically offered stable returns. However, this strategy is becoming risky as climate policies tighten and markets shift to clean energy.

Can retirement funds support climate-friendly investments?

Yes. Pension funds can divest from fossil fuels and invest in green bonds, renewable energy. It has sustainable infrastructure securing returns and protecting the planet.

Are sustainable investments as profitable as traditional ones?

In many cases, yes. Studies show that sustainable investments often match or outperform fossil fuel stocks in the long run, with lower environmental risk.

What can individuals do about their retirement fund’s impact on climate?

You can ask your pension provider where your money is invested, support funds with strong environmental policies, or shift to ESG (environmental, social, governance) funds.

CONCLUSION

For a sustainable future and the reduction of climate crises, in a world where people prosper in harmonious collaboration with the environment and leave a huge footprint on the environment, it’s your responsibility to invest in projects that are more secure and reflect those guiding principles.

By choosing the right retirement funding, we need to keep in mind that investing not only benefits us in the future for the long term but also ensures that it will help keep our environment healthy and sustainable. We must focus not only on our immediate goal but also on the long-term vision of our plan.

By investing in renewable resources, sustainable agriculture, and innovative technologies, we can create a world that is more sustainable, profitable, and ecologically vibrant. We cannot deny our contribution to the climate crisis, and we are the culprits for future generations, as they will face the circumstances we are creating for them. We are responsible for the world they will inherit. We must invest in both financial growth and environmental sustainability so that future generations can enjoy and benefit from both financial and environmental resources mutually.

Key takeaways

- Fossil fuel-free funds and investments

- Renewable energy resource alternatives

- Awareness among people

- Sustainable and eco-friendly infrastructure

- Support climate-friendly companies and green bonds

REFERENCES

Arthur Rempel, Joyeeta Gupta,Energy Research & Social Sciece.Volume 69,2020,

(https://www.sciencedirect.com/science/article/pii/S221462962030311X)

Aaberge, R., Liu, K., & Zhu, Y. (2017). Political uncertainty and household savings. Journal of Comparative Economics, 45(1), 154–170. https://doi.org/10.1016/j.jce.2015.12.011

Bishen, S., Glick, S., & Wyman, O. (2024). Quantifying the impact of climate change on human health. World Economic Forum Insight Report. Retrieved from https://www3.weforum.org/docs/WEF_Quantifying_the_Impact_of_Climate_Change_on_Human_Health_2024.pdf

Canals-Cerda, J. J., Roman, R. (2021). Climate change and consumer finance: A very brief literature review. FRB of Philadelphia Payment Cards Center Discussion Paper, 21(4).

Francis, J. J., Johnston, M., Robertson, C., Glidewell, L., Entwistle, V., Eccles, M. P., & Grimshaw, J. M. (2010).Operationalizing data saturation for theory-based interview studies. Psychology and Health, 25(10), 1229–1245.

John is a professional blogger and passionate advocate for environmental sustainability. With years of experience exploring eco-friendly practices and green innovations, he shares insightful articles on Planet Flagship to inspire a sustainable future. John’s expertise lies in making complex environmental topics accessible and actionable, empowering readers to make meaningful changes for the planet.