Introduction

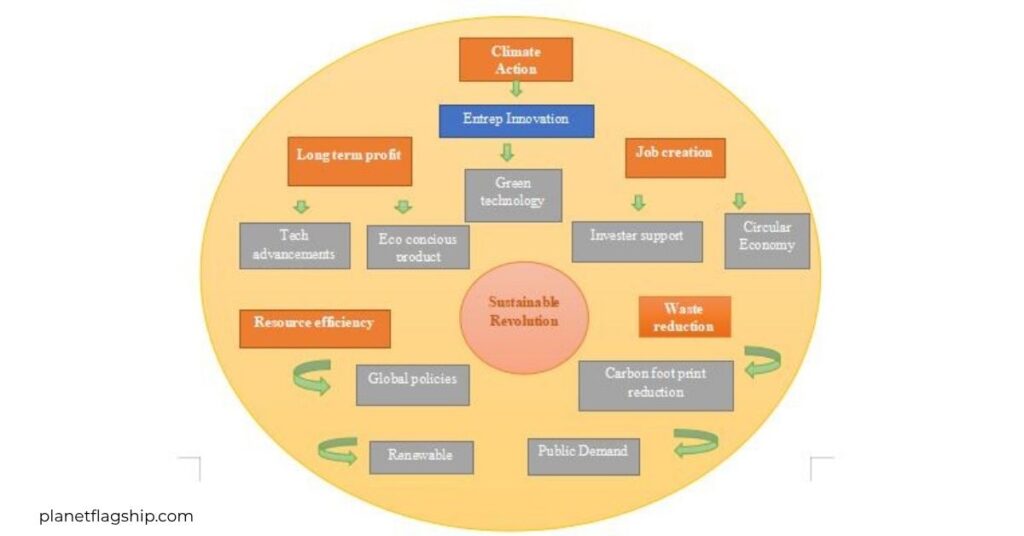

Green Startup Boom market growth has already begun in both green technology and sustainability, yet this sector continues to expand. Experts predict that the market will reach $70 billion by 2030, driven by exceptional innovation and a rising sense of urgency (Sheppard, 2020). The new business generation prioritizes sustainability above all else, driving entrepreneurs to develop startups that produce both lab-grown meat and sustainable packaging materials (Leaders, 2022). The transition toward change operates outside isolated conditions.

Business operations are undergoing fundamental changes because of the accelerating climate emergency and rising customer interest in ethical consumerism, alongside significant regulatory transformations. The European Green Deal, introduced by the EU, and the US Inflation Reduction Act are both governmental initiatives aimed at accelerating climate-beneficial developments (Kleimann et al., 2023). Both consumers, as well as Gen Z and Millennials, adjust their purchasing power toward brands that align with their identity values (Anton, 2024). Green startups benefit from increased investment in billions of environmental, social, and governance (ESG) funds, which transform them into significant economic forces (Singh & Tarkar, 2024).

The current environmental situation enables green startups to undertake tasks that exceed traditional carbon footprint reduction. These organizations revolutionize conventional sectors while simultaneously establishing circular systems and developing markets based on environmentally sound concepts. Profitability and eco-friendly business operations are proven to be compatible through companies that specialize in clean tech, sustainable agriculture, and zero-waste fashion (Younus, 2025).

The article examines how green startup corporations have acquired momentum by analyzing their successful business sectors, technological frameworks, and financial investment patterns (Siefkes et al., 2025). Startups demonstrate both environmental problem-solving capabilities and the ability to develop a sustainable economy while delivering superior business results. The critical time this decade demands climate action has pushed unlikely yet powerful green entrepreneurs into becoming heroes driving the sustainability revolution (Jones, 2017).

Green Startup Emergence

Green startups have more value than a basic environmental design because they achieve true sustainability integration throughout their organizational structure. The startup sector designs eco-friendly products that decrease environmental damage by implementing novel concepts based on zero-waste production, renewable materials, and circular economy principles, as well as carbon-neutral business practices (Musta, 2022). Economic viability stands alongside environmental problem-solving as the distinguishing factor of these businesses.

Climate Change as a Key Driver

Climate change has been causing unprecedented storms, dangerous heatwaves, and the loss of various kinds of biodiversity, and this sense of urgency has been mounting. Consumers, governments, and corporations realize that changes are not incremental enough. As startups take action and present bold solutions, while legacy businesses lag behind, new companies are demonstrating greater agility and taking more risks (Majka, 2024).

ALSO READ: How Youth Activists Are Leading the Fight for Climate Change?

Conscious Consumers Demand

Today, they are more concerned with products based on values than just price or convenience. According to Nielsen’s report, 73% of global consumers stated they would change their consumption habits to decrease environmental impact and would definitely or probably do so (Nielsen & Schmidt, 2014). The rising demand for sustainable alternatives, combined with the competitive advantage of green startups resulting from the changing cultural shift, is fueling the demand.

Key Sectors for Green Startups

Green entrepreneurship is taking root across a range of industries, transforming how we produce energy, grow food, manage waste, and even get dressed. Here are the sectors where green startups are making the biggest waves:

Renewable Energy and Clean Technology

The same is true of the sustainability revolution and clean energy. Solar, wind, and battery technologies all play a role in the innovation space for startups, led by renewables that are more efficiently powered and accessible to a wider audience. Swell Energy is a company that optimizes home battery systems for grid resilience. A company like that develops microgrids and off-grid solutions for underserved regions (El Bassam et al., 2013). Clean tech startups are laying the groundwork for a carbon-free future energy.

Sustainable Agriculture and Food Tech

Conversely, green startups are revolutionizing our global food system, a significant contributor to greenhouse gas emissions. Companies like Beyond Meat and Upside Foods are virtually eliminating the environmental impact associated with protein production, and this trend is expected to continue growing (McClements, 2023). At the same time, startups like Plenty and Farmer’s Footprint are achieving this by utilizing data, automation, and closed loops to grow food sustainably in both urban and rural areas (Sreenivasan & Suresh, 2024).

Circular Economy and Waste Management

Startups are now implementing waste elimination approaches, hallmarks of the circular economy, in their business operations. Refill systems and replacements for traditional plastic packaging are being implemented by TerraCycle, Loop, and other businesses through innovative models and biodegradable product development (Baczkowska, 2021). The e-waste and textile waste industries utilize startup-developed technologies that extract beneficial components and revitalize products, thus minimizing the amount of waste that must be deposited in landfills (Hernández-Chea et al., 2020).

Green Transportation and Mobility

The shift in our movements results from the rising popularity of EVs and shared mobility services. Rivian, Ola Electric, Arcimoto, and other startups are developing next-generation EVs for the market, while various companies focus on low-emission delivery services, charging infrastructure development, and battery recycling programs (Shelar, 2024). Modern technological developments are making green transportation more accessible and affordable for both urban and rural customer markets.

Green Startups Overcoming Traditional Industries

Case Studies

Startups in green show that sustainability can be profitable too. For example, Tesla, one of the first movers in the electric vehicle space, has disrupted the automotive industry, and its stock has outperformed the market by over 1,000 percent in the last five years, showing that green businesses can compete with conventional industries on financial performance (Liu et al., 2025).

The company’s market value has experienced significant growth as customers worldwide demand more sustainable food solutions. The energy and automotive sectors contain Tesla as their most well-known disruptor. Through its approach to electric vehicle development, Tesla initiated a global shift toward electric vehicles and clean battery technology. Ford and General Motors, along with other traditional automotive manufacturers, are rapidly introducing electric models through their product lines (Slowik et al., 2022).

Patagonia, which has established its reputation through environmental leadership, now leads the fashion sector by promoting its Worn Wear circular system, which extends product life spans and offers products for resale (Stathis, 2023). Mission-driven startups demonstrate an inspirational power that prompts established brands to adopt responsible business strategies, which in turn contribute to their success.

The preliminary expenses involved in launching green startup ventures remain substantial despite their existing achievements. Manufacturing electric vehicles and conducting related research and development during the transition require large upfront costs, with EV batteries specifically contributing 40-50% of the manufacturing expenses (Yang et al., 2022). The reduced cost of battery technology allows electric vehicle prices to decrease steadily because per-kilowatt-hour prices dropped from $1,100 in 2010 to $137 in 2020 and continue to decrease (Busch, 2021).

Role of Technology in Green Startups

Technology is the backbone of the green startup revolution. From real-time data analytics to blockchain verification, startups are leveraging advanced tools to boost efficiency, reduce emissions, and scale sustainable solutions at unprecedented speeds.

AI and Smarter Sustainability

The combination of artificial intelligence (AI) and big data technologies enables startups operating in sustainable fields to make informed choices at an enhanced speed (Obschonka & Audretsch, 2020). Renewable energy operations utilize AI for predicting solar and wind potential, as well as for grid optimization and resource allocation. Two startup companies, AmpX and Autogrid, utilize artificial intelligence to regulate supply-demand dynamics, thereby providing more affordable and reliable energy (Ahmed et al., 2025). AI platforms analyze soil health conditions, weather data, and farming output performance to implement precision agriculture methods, which reduce production expenses while enhancing output results (SS et al., 2024).

Resource conservation and lower food production emissions result from these methods. Significant improvements in energy efficiency are achieved through the integration of AI and big data technologies. Through its data center cooling system powered by AI, Google has decreased energy usage by 40%, thus saving approximately $100 million per year. The Agro-smart analytics platform achieves higher crop yields of 30% with concurrent reductions in water consumption of up to 20% (Mowla et al., 2023).

Transparency and Traceability

The power of blockchain technology enables green startups to create verifiable, tamper-proof records, which are crucial in fashion production, mining operations, and the carbon offset market. Through blockchain operations, Provenance and Everledger track products throughout their entire life cycle, from origin to store shelves, while building an ethical supply chain and sustainability integrity (Nwariaku et al., 2024). Blockchain operates in the carbon market as a system for issuing and following digital carbon credit transactions.

Technology enhances organizational responsibility while combating greenwashing, thereby enabling companies and customers to easily support genuine climate response initiatives. Blockchain technology delivers major efficiency enhancements through its applications in the market. Blockchain solutions at Everledger resulted in a 40% decrease in fraud rates for their operations, which focus on diamond tracing and high-value asset tracking (Khadka, 2024). By reducing intermediaries from the process, blockchain enables fast, real-time carbon credit trading, minimizing market transaction costs by up to 80% in the carbon credit market (Yadav et al., 2025).

IoT Systems

Through the Internet of Things (IoT), physical objects such as sensors, appliances, and vehicles connect to exchange and collect data. Quantified Systems reduces environmental effects through IoT technologies, which develop both intelligent city frameworks and green buildings combined with pollution measurement systems. The commercial products Tado and EnOcean enable homes and office spaces to reduce their energy consumption by controlling heating and lighting automation according to occupancy habits (Joshi, 2023).

Green startups utilize these technological tools to develop models that other entities can use as they work to accelerate the shift toward a sustainable economy. Through the Internet of Things (IoT), organizations can achieve maximum energy efficiency in building complexes and urban areas (Fakhabi et al., 2024). Smart building technologies can decrease energy consumption by 30-40%, according to a McKinsey analysis (Bloom & Gohn, 2012). Enel X implements IoT sensors through demand-response programs, which have resulted in participating buildings reducing their peak load energy demand by 20% (Mitchell et al., 2025).

Funding & Investment Trends in Green Startups

Venture Capital and Impact Investing

Lawmakers should create tax incentives to target the financial sector, as venture capital firms focusing on ESG (Environmental, Social, and Governance) principles, along with impact investing, are increasingly funding green startup ventures (Gutterman, 2024). Many Ventures led the way under Bill Gates in funding climate technology innovation, including zero-carbon cement, next-generation batteries, and other climate innovations. Lower Carbon Capital and the Green Angel Syndicate, two investment vehicles, focus exclusively on early-stage, pre-revenue startups addressing climate and sustainability challenges (Mkhize, 2023).

Knowledgeable investors recognize that green startups require additional time but can produce extensive benefits, along with strong financial returns, in the long run. Startup green companies have experienced significant growth in investor funding over the past few years. The Crunchbase database indicates that clean energy startup funding increased by 30% annually from 2019 to 2023, when investors contributed $16.1 billion that year (Maunder, 2024).

Crowdfunding and Community-Backed Capital

Alternative funding systems are now spreading throughout the market. Sustainability-focused startups obtained funding from individual investors via Seedrs, Crowdcube, and Start Engine (Vismara, 2018). Through this community-driven funding method, brands welcome different sources of capital while simultaneously attracting devoted environmental stakeholders. A new model of equity crowdfunding exists that shows backers both their monetary gains and startup ecological accomplishments through reporting features.

This framework gives people an opportunity to become co-beneficiaries of the green transformation. Green startup businesses now find practical success through the crowdfunding system (Caputo et al., 2022). Green Crowd achieved substantial funding growth in 2020, with a 150% yearly increase, while raising $10 million for sustainable ventures (Nicholls, 2021). The “environment” project segment on Kickstarter achieved full funding for 44% of its initiatives, indicating strong backing from Kickstarter users for green startup concepts (Gómez-Olmedo et al., 2024).

The Future of Green Startups

Emerging Trends on the Horizon

Contemporary green businesses operating in the market tackle advanced environmental challenges. Advancements in storage and production now promote the popularity of what was previously viewed as an expensive solution for hydrogen energy. Low-carbon hydrogen solutions are being developed by startup companies H2Pro and Sunfire, specifically for sectors that cannot easily be converted to electricity (Salehi, 2023). The hydrogen energy sector attracts numerous green firms, with a projected market expansion to $180 billion by 2030, while striving to produce 18% of the global energy supply during the mid-century period (Hosseini, 2024).

In the current situation, carbon capture and storage (CCS) is a rapidly advancing field. To scale such technologies, two companies, Clime-works and Charm Industrial, have developed technologies involved in the absorption of atmospheric CO₂ and its conversion into stable carbon sinks (Sen, 2021). Before researchers decided on their position regarding existing fields, biodiversity technology emerged as an independent research domain. Emerging technology companies utilize drones equipped with artificial intelligence software and remote sensing capabilities to monitor extinction patterns and restore habitats, making them essential for preventing environmental degradation (Bekmurzaeva et al., 2024).

Roadblocks and How to Overcome Them

Despite the promise, challenges remain. Most green startups face barriers in scaling their operations while competing with established legacy firms that utilize existing structures backed by governmental support. The pace of progress is reduced when customers doubt the benefits of green products, agencies delay regulations, and governments remain indecisive about their environmental policies.

The advancement of startups toward sustainability requires enhanced policy support, including sustainable pricing structures and mandatory green purchasing requirements, as well as policies that promote environmentally friendly innovation. Education and public relations activities function in tandem with mainstream consumer conversion and the normalization of sustainable alternatives.

High financial costs typically accompany the growth of green startup ventures. According to the International Renewable Energy Agency (IRENA), an investment of $131 trillion will be necessary to expand renewable energy technology by 2050. Total economic benefits from clean energy investments amount to three to five times the original investment dollar, according to IRENA (Fajrian et al., 2023).

Revolution of Green Startup

The green startup revolution requires involvement from all stakeholders, as everyone plays a crucial part in accelerating the global transition to sustainability. Multiple options exist to participate in the green startup expansion if you want to launch your business, support environmentally conscious brands, or make sustainable investments.

If one is passionate about sustainability and eager to make a difference, launching a green startup could be the perfect avenue. Here are a few steps to get started:

- Should locate a missing piece in the green economy because there are problems such as waste management issues alongside renewable energy and sustainable food concerns. Evaluate both the market directions and the tendencies of consumers to confirm the existence of demand for your proposed solution.

- Sustainability serves as an essential factor, yet profit development remains the primary driving force for enduring business success. You need to establish an operational blueprint that strikes a balance between environmental effectiveness and economic sustainability for scalability. Your startup must find ways to expand operations while maintaining competitiveness in the current market landscape.

- Should employ modern technology together with innovative methods to enhance efficiency and create innovative products or services. The implementation of AI alongside blockchain and IoT represents a means through which technology strengthens the influence of your startup.

- Search for investors who specifically pursue businesses that support their ethical goals. You should not hesitate to examine crowdfunding systems or accelerator training for green business founders.

Identification of High-Impact Sustainability Ventures

The best investment avenue for you would be green startup businesses, as they generate financial returns while also making real, positive climate changes. ESG investments continue to grow at a rapid pace, but investors can find numerous platforms through which they can direct their funds toward sustainability-based ventures. Through thorough research, you can evaluate the expected impact of startups before making your investment decisions.

The green startup boom extends beyond a popular movement because it serves as a powerful influence that directs the development of global industries. Contrary to traditional approaches, entrepreneurs are employing innovative solutions to lead the response against climate change, resource depletion, and environmental destruction. The startup sector demonstrates how companies can develop successful businesses that simultaneously support human interests and environmental protection.

The expansion of this movement requires technological advancements, significant investments, and supportive policies to enable startups to fully develop their potential. Moving forward, the next decade is expected to yield more exceptional and innovative solutions, including carbon capture technologies and biodiversity monitoring, creating a path of new business and investment opportunities specifically for green entrepreneurs and investors to pursue. The path to success proves difficult in its entirety. Green startups face numerous challenges, including substantial initial expenses, regulatory hurdles, and high public acceptance standards. Innovative collaborations, combined with a continued dedication to sustainability, drive these companies to construct a lasting, sustainable global economy.

FAQ’s

What is driving the rapid growth of green startups?

The surge in green startups is fueled by climate urgency, changing consumer values, and government policies like the EU Green Deal and US Inflation Reduction Act. These factors push innovation in clean tech, sustainable agriculture, and circular economy models. Investors are increasingly directing funds toward businesses that balance profit with environmental impact.

Which industries are most impacted by green startup innovation?

Key sectors include renewable energy, sustainable agriculture, waste management, and green transportation. Startups are pioneering solar and wind solutions, lab-grown meat, zero-waste packaging, and electric vehicles. These industries are seeing rapid adoption as technology becomes more affordable and accessible.

How does technology accelerate green startup success?

Advanced tools like AI, blockchain, and IoT are enabling startups to boost efficiency, cut emissions, and ensure transparency. AI optimizes renewable energy grids, blockchain verifies ethical supply chains, and IoT reduces energy use in buildings. These innovations help scale sustainable solutions faster than ever.

What challenges do green startups face in scaling their operations?

Green startups often struggle with high upfront costs, limited infrastructure, and competition from established players. Regulatory delays and consumer skepticism can also slow growth. Overcoming these barriers requires supportive policies, strong investor backing, and public education on the benefits of sustainable products.

Why are investors increasingly funding green startups?

Investors see green startups as both profitable and impactful, with the potential to deliver strong long-term returns. ESG-focused venture capital, impact investing, and crowdfunding platforms are channeling billions into clean energy, sustainable food, and climate tech innovations. This funding boom is expected to keep growing through the next decade.

Conclusion

The green startup boom is transforming industries, proving that sustainability and profitability can thrive together. From renewable energy to zero-waste fashion, these innovators are tackling climate change with bold solutions powered by AI, blockchain, and IoT. Investors, policymakers, and conscious consumers are fueling this momentum, creating a multi-billion-dollar market poised for even greater growth. Now is the time to support, invest in, or launch your own green venture. Every choice from the brands you back to the technologies you adopt shapes a sustainable future. Join the sustainability revolution today and be part of the change that drives both economic growth and environmental protection.

References

Ahmed, F., Uzzaman, A., Adam, M. I., Islam, M., Rahman, M. M., & Islam, A. M. (2025). AI-Driven Microgrid solutions for enhancing energy access and reliability in rural and remote areas: A Comprehensive review. Control Systems and Optimization Letters, 3(1), 110–116. https://doi.org/10.59247/csol.v3i1.183

Anton, A. (2024). “Other Customer” Perception as Strategic Insight into Gen Z Consumer–Brand Identification and Purchase Behavior: A Mixed-Methods Approach. American Behavioral Scientist, 00027642241235838.

Baczkowska, J. R. (2021). Sustainable Beauty (Master’s thesis, Pratt Institute).

Bekmurzaeva, R., Kalimullin, R., & Aguzarova, F. (2024). Application of drones and artificial intelligence to monitor and protect natural ecosystems. In BIO Web of Conferences (Vol. 140, p. 01008). EDP Sciences.

Bloom, E., & Gohn, B. (2012). Smart buildings: Ten trends to watch in 2012 and beyond. Pike Research: CleanTech Market Intelligence.

Busch, C. (2021). Used Electric Vehicles Deliver Consumer Saving Over Gas Cars. Energy Innovation: Policy and Technology, LLC.

El Bassam, N., Maegaard, P., & Schlichting, M. (2013). Distributed renewable energies for off-grid communities: strategies and technologies toward achieving sustainability in energy generation and supply. Newnes.

Fajrian, S., Barbalho, A., Lozo, S., Bianco, E., Akande, D., Escamilla, G., … & Duma, D. (2023). About IRENA.

Fakhabi, M. M., Hamidian, S. M., & Aliehyaei, M. (2024). Exploring the role of the Internet of Things in green buildings. Energy Science & Engineering, 12(9), 3779-3822.

Gómez-Olmedo, A. M., Diéguez, M. E., & Pascual, J. A. V. (2024). Redefining success in innovative crowdfunding projects: Empirical evidence of effective mindful consumption promotion in Kickstarter. Journal of Innovation & Knowledge, 9(4), 100558.

Hernández-Chea, R., Vimalnath, P., Bocken, N., Tietze, F., & Eppinger, E. (2020). Integrating intellectual property and sustainable business models: The SBM-IP canvas. Sustainability, 12(21), 8871.

Jones, G. (2017). Profits and sustainability: A history of green entrepreneurship. Oxford University Press.

Joshi, A. (2023). Optimising the Energy Efficiency of a Building Using Smart Control Systems: designing a customised smart heating system with EnOcean hardware for hydronic heating systems to conserve energy.

Khadka, R. (2024). The impact of blockchain technology: Enhancing sustainable supply chain management in Finnish manufacturing industries.

Kleimann, D., Poitiers, N., Sapir, A., Tagliapietra, S., Véron, N., Veugelers, R., & Zettelmeyer, J. (2023). How Europe should answer the US inflation reduction act (No. 04/2023). Bruegel Policy Contribution.

Leaders, Y. (2022). Venture Capital Opportunities in Food and Agricultural Technology. Venture Capital.

Liu, C., Boothman, S. G., & Graham, J. D. (2025). The rise and recent decline of Tesla’s share of the US electric vehicle market. World Electric Vehicle Journal, 16(2), 90. https://doi.org/10.3390/wevj16020090

Majka, M. (2024). From startup to enterprise: Navigating the transformation process.

McClements, D. J. (2023). Meat less: The next food revolution. Springer Nature.

Mitchell, J., Mailewa, A. B., Akuthota, A., & Mohottalalage, T. (2025, January). IoT-Driven Energy Management and Optimization: A Comprehensive Review and Case Study Analysis. In 2025 IEEE 15th Annual Computing and Communication Workshop and Conference (CCWC) (pp. 00292-00298). IEEE.

Mkhize, H. (2023). A Financial Guidebook For US Startups: Crossing Climate Tech’s Valleys of Death and Achieving Scale.

Musta, E. (2022). Guide to Circular and Green Economy for Startups.

Nielsen, R., & Schmidt, A. (2014). Changing consumer behaviour towards increased prevention of textile waste: Background report.

Nwariaku, N. H., Fadojutimi, N. B., Lawson, N. L. G. L., Agbelusi, N. J., Adigun, N. O. A., Udom, N. J. A., & Olajide, N. T. D. (2024). Blockchain technology as an enabler of transparency and efficiency in sustainable supply chains. International Journal of Science and Research Archive, 12(2), 1779–1789. https://doi.org/10.30574/ijsra.2024.12.2.1454

Salehi, M. (2023). The 9 Startups Reshaping Our Path to a Sustainable Future: Revolutionizing Green Energy. Available at SSRN 4431629.

Sen, G. (2021). Capture of CO2. Climate Change and Green Chemistry of CO2 Sequestration, 181.

Shelar, R. (2024). Accelerating the Shift to Electric: Challenges, Opportunities and Strategies.

Sheppard, B. H. (2020). Ten Years to Midnight: Four Urgent Global Crises and Their Strategic Solutions. Berrett-Koehler Publishers.

Siefkes, M., Bjørgum, Ø., & Sørheim, R. (2025). Business angels investing in green ventures: how do they add value to their startups?. Venture Capital, 27(1), 79-108.

Singh, R., & Tarkar, P. (2024). An empirical analysis on sustainable startup: Embedding Environmental, Social and Governance (ESG) into high growth business strategy. Brazilian Journal of Operations & Production Management, 21(3), 1810-1810.

Slowik, P., Isenstadt, A., Pierce, L., & Searle, S. (2022). Assessment of light-duty electric vehicle costs and consumer benefits in the United States in the 2022–2035 time frame. International Council on Clean Transportation.

Sreenivasan, A., & Suresh, M. (2024). Sustainability-controlled measures for resilient management of fresh and short food startups supply chain. Sustainable Manufacturing and Service Economics, 3, 100024.

Stathis, M. (2023). Shaping our fate: Analyzing circular economy principles in corporate sustainability strategy as a critical climate solution for the apparel industry (Doctoral dissertation, University of Oregon).

Vismara, S. (2018). Sustainability in equity crowdfunding. Technological Forecasting and Social Change, 141, 98–106. https://doi.org/10.1016/j.techfore.2018.07.014

Yadav, A. P., Mulik, V. P., Kasar, M. S., Vitekar, A. B., Shelke, S. V., & Patil, S. M. (2025). Carbon credits and environmental impact tracking: the role of blockchain in supporting efficient and secure carbon credit markets. Ecological Engineering & Environmental Technology (EEET), 26(4).

Yang, Z., Huang, H., & Lin, F. (2022). Sustainable electric vehicle batteries for a sustainable world: perspectives on battery cathodes, environment, supply chain, manufacturing, life cycle, and policy. Advanced Energy Materials, 12(26), 2200383.

Younus, M. (2025). The Economics of A Zero-Waste Fashion Industry: Strategies To Reduce Wastage, Minimize Clothing Costs, And Maximize & Sustainability. Strategic Data Management and Innovation, 2(01), 116-137.

John is a professional blogger and passionate advocate for environmental sustainability. With years of experience exploring eco-friendly practices and green innovations, he shares insightful articles on Planet Flagship to inspire a sustainable future. John’s expertise lies in making complex environmental topics accessible and actionable, empowering readers to make meaningful changes for the planet.